December 23, 2013 - With every slip and fall, every bruise and ache, the reality set in: Henry Schaffer, 86, could no longer live on his own. So his daughter, Kristi, began searching for a retirement home — and the money to pay for it.

snip Lawyers, financial advisers and insurance brokers have formed a lucrative alliance with retirement communities and assisted living facilities to extract many billions of taxpayer dollars from the V.A., according to interviews with state and federal authorities, as well as a review by The New York Times of hundreds of legal documents and client contracts.

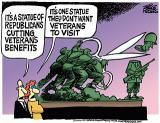

Questionable actors are capitalizing on loose oversight to unlock the V.A. money and enrich themselves, sometimes at veterans’ expense. The V.A. accreditation process is so lax that applicants provide their own background information, including any criminal records. But the V.A. has only four full-time employees evaluating the approximately 5,000 applications that it receives annually.

snip The development recalls the array of questionable business practices involving seniors and Medicaid. Indeed, many of the firms that zeroed in on those programs in the past have recast themselves as V.A. specialists. More than 200 firms nationwide now focus on V.A. retirement benefits, according to the Government Accountability Office. read more>>>

Present times little in difference to past decades and wars from:

Then, when we started a second simultaneous war in another country, we gave ourselves a second huge round of tax cuts. After that second war started. The wars, I guess, we thought would be free, don`t worry about it, civilians. Go about your business." 23 May 2013

No comments:

Post a Comment