Paying back their huge rubber stamped debt, the rubber stamping and rapid deficit growth started before 9/11 and these two present over a decade wars, on the backs of student veterans' and the rest of the students as well as everyone from the middle down to the poorest already among us including the seniors who grew up in and then into what was being built once and the past some forty years being torn down, rapidly in this new century!!

July 4, 2013 - Anthony Paolino, a senior at Providence College, worries the new interest rate will harm veterans. Paolino, who has been on five deployments, including Iraq and Afghanistan, is also a counselor for veterans who need loans for college expenses not covered by the GI Bill. Because the new rate will add $2,600 to the average student debt, he said some veterans won't even consider college.

"They're already having transitional struggles," Paolino said of veterans. "I'm concerned, as an advocate, that a lot of our students will be discouraged - even if it's just a little bit - they would be discouraged enough for them to walk away."

Both parties in Congress agree that 6.8 percent is too high; they just don't agree on how to fix it. And by going home on recess last Friday, Congress missed its own deadline for avoiding the increase.

The Republican-controlled House did pass a bill that ties student-loan rates to the U.S. Treasury borrowing cost, plus 2.5 percent. This week that rate would be 5 percent, but the rate could vary and float up to a maximum of 8.5 percent.

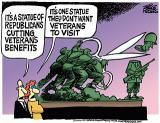

But the Republican bill would also help lower the deficit by $3.7 billion, and that amount is a problem for most Senate Democrats. Majority Leader Harry Reid says it's too much to collect from students.

"We don't think there should be deficit reduction based on the backs of these young men and women trying to go to college," Reid said. read more>>>

No comments:

Post a Comment