While the wealthy still reap, directly from or indirectly through investments, wealth from two ongoing wars of their choice!

The GOP disappeared a couple of decades back and this so called TEA party is made up mostly by those that fully supported the rubber stamping of the wars, all costs associated with and all other treasury costs, on the credit card, of other issues during the previous administration and tepub congresses as well as the obstruction on all issues since while also supporting the many extra state and federal costs of on frivolous laws passed, like voter ID cards, suppressing citizens rights of choice and participation in democracy!

Aug 31, 2011 - 2012 GOP presidential hopeful Jon Huntsman is releasing an economic plan today that is as bad for the middle-class — and as nutty — as any proposed by his rivals. It would pay for a half-million-dollar tax break for the richest 0.1 percent of Americans with tax increases on the middle-class and new taxes on seniors, veterans, and poor families.

In an apparent attempt to eclipse all previous Republican giveaways, including the disastrous Bush tax cuts, Huntsman would drop the marginal rate paid by the richest Americans by more than a third to 23 percent — a lower rate than rich people paid during the Coolidge and Hoover Administrations or any time since. He would also eliminate all taxes on all capital gains and dividend income — the primary forms of income for the wealthiest Americans.

Huntsman says he will pay for this supply-side bonanza by eliminating all so-called “tax expenditures.” He probably borrowed the idea from a theoretical scenario described by the President’s Commission on Fiscal Responsibility and Reform (aka, the deficit commission). The Commission observed that if all tax expenditures were eliminated, income tax rates could, in theory, be consolidated into three brackets: 8, 14, and 23 percent — the same as what Huntsman proposed today.

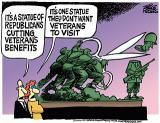

But the Commission only offered that scenario as a thought experiment, not as a serious proposal. In fact, no one has seriously proposed to eliminate all tax expenditures because doing so would punish seniors, the middle-class, poor families, and veterans, among others. read more>>>

No comments:

Post a Comment