Apparently what started out as some thinking this might be a better way to help and handle the Death Benefits of Soldiers, and possibly others, didn't stay that way as Corporate Greed stepped in and like everything else rules were developed, over the past decade, and not explained properly or just left unexplained to those who were receiving the Death Insurance Policies Payouts!

Veterans Affairs to Investigate Fallen Soldiers' Death Benefits

Jul 28, 2010 The U.S. Department of Veterans Affairs said it is conducting a “full investigation” into a report that life insurance companies are putting veterans’ death benefits in corporate accounts and keeping most of the investment profits instead of paying the survivors.

The agency was responding today to a report in Bloomberg Markets magazine on what has become a standard practice for life insurance policies issued by companies including Prudential Financial Inc. and MetLife Inc.

Instead of paying a lump sum to survivors when a policyholder dies, insurers keep the money in their own accounts, pay uncompetitive interest rates to survivors and give them misleading guarantees about the safety of the funds.

“The possibility that life insurance companies are profiting inappropriately from these service members’ sacrifice is completely unacceptable,” Mike Walcoff, acting undersecretary for the agency’s Veterans Benefit Administration, said in an e-mailed statement. “The VA is conducting a full investigation into the life insurance companies and their procedures in this program.”

Snip

‘Outraged’

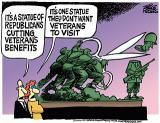

House Veterans Affairs Committee Chairman Bob Filner said he was “outraged” that insurance practices appear to result in “corporations retaining the assets in corporate accounts, profiting from the interest, and failing to pass accrued interest to surviving families.” The California Democrat said VA officials should “demand answers” about the program.

“The purpose of these benefits is to assist grieving survivors -- not to improve insurance company profits,” said Daniel Akaka of Hawaii, chairman of the Senate Committee on Veterans Affairs.

Snip

$28 Billion

Insurers are holding onto at least $28 billion owed to survivors, according to three firms that handle the retained- asset accounts for about 130 life insurance companies.

House Armed Services Committee Chairman Ike Skelton, a Missouri Democrat, said U.S. troops’ survivors must be provided more information about how to handle death benefits. He said insurance companies should be examined to “make sure they aren’t misrepresenting the options being offered to surviving family members.”

Skelton said his committee will “assist in finding a remedy for this problem.”

Since 1999, the Veterans Administration has allowed Newark, New Jersey-based Prudential to use this procedure in providing benefits to survivors of fallen soldiers. In 2009, the families of U.S. soldiers and veterans were supposed to be paid death benefits totaling $1 billion immediately, according to their insurance policies. They weren’t. Continued

From the Bloomberg report above:

`Shadow Banking System' of Retained Asset Accounts

July 28 (Bloomberg) -- David Evans talks with Bloomberg's Scarlet Fu about his investigation into retained-asset accounts by life insurers and how the insurers profit from these accounts at the expense of grieving families. (Source: Bloomberg)

CBS NEWS: A Fallen Hero: How an Insurance Company Profited

Katie Couric Reports on One Family's Experience with Dead Soldier Benefits and a Giant Insurance Firm

No comments:

Post a Comment